IRS W-3 Transmittal Form: Guide for Employers

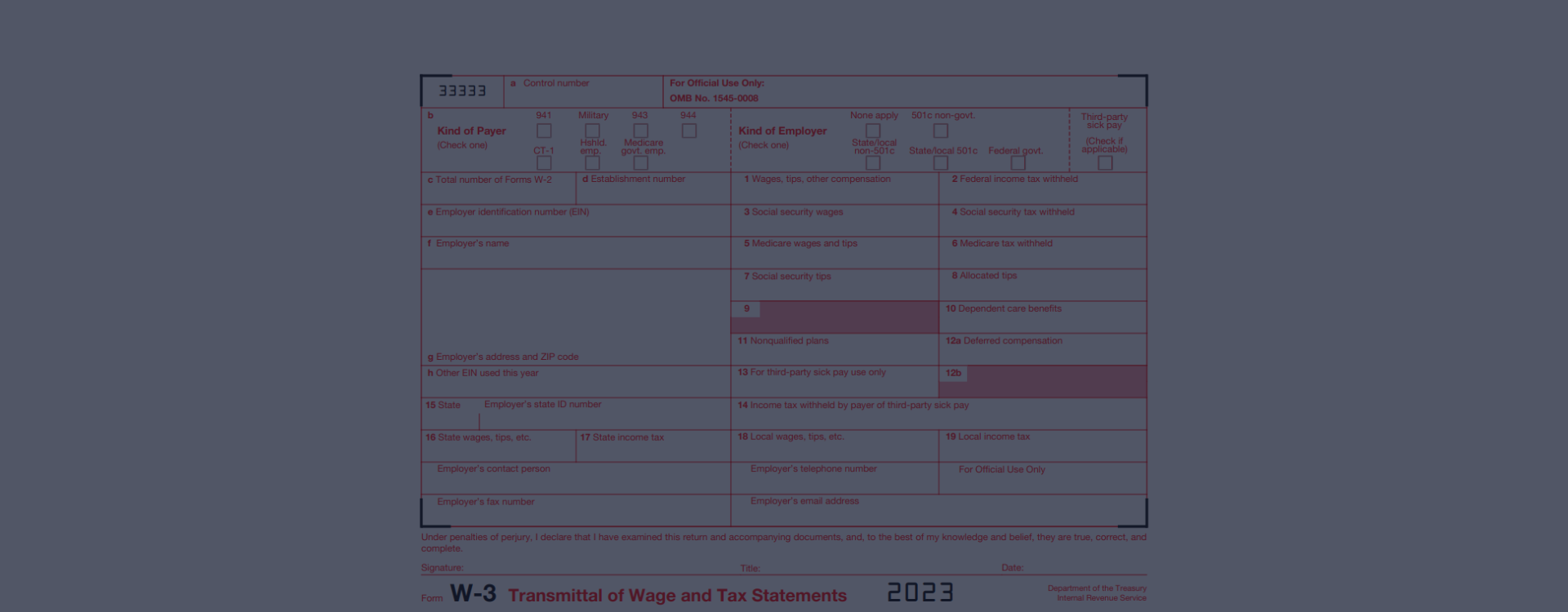

Form W-3, known officially as the Transmittal of Wage and Tax Statements, is a required document for employers in the United States. This particular form functions as a summary of an employer's reported salaries, tips, and compensations that it pays to its employees over a given fiscal year. Simply put, the IRS W-3 form in 2023 acts as the key source for income data verification.

Our Website Benefits

In pursuing an easier way of handling tax documentation, experts and employers alike find value in comprehensive resources like form-w3.com. Our website provides an accessible blank W-3 form for 2022 and the upcoming years, enabling you to submit accurate information timely. Beyond just readily available forms, visitors can also access Form W-3 instructions in PDF, a highly useful feature that offers step-by-step guidance. Through this, you can mitigate any potential errors while completing the form, ensuring adherence to the IRS guidelines. This digital resource hub's secondary value rests in its illustrative examples, a convenient aid for anyone unfamiliar with tax documentation protocols.

The W-3 IRS Form Purpose in 2023

-

![Compilation]() CompilationAt its core, the W-3 primarily accumulates all relevant tax data related to an employer’s workforce. Each W3 template carefully gathers, organizes, and presents a thorough summary of wages, tips, and other compensation paid to employees during the fiscal year.

CompilationAt its core, the W-3 primarily accumulates all relevant tax data related to an employer’s workforce. Each W3 template carefully gathers, organizes, and presents a thorough summary of wages, tips, and other compensation paid to employees during the fiscal year. -

![Verification]() VerificationIt also plays a crucial role in corroborating the accuracy of this information. It cross-checks the individual W-2 samples, ensuring the total amounts reported on all W-2 forms align with the numbers stated on the W-3 form. This step bolsters the credibility of the submitted data.

VerificationIt also plays a crucial role in corroborating the accuracy of this information. It cross-checks the individual W-2 samples, ensuring the total amounts reported on all W-2 forms align with the numbers stated on the W-3 form. This step bolsters the credibility of the submitted data. -

![Submission]() SubmissionLastly, the W-3 enables the centralized conveyance of this aggregated and verified wage and tax information to the Social Security Administration (SSA). This process streamlines administration and ensures fair, efficient, and accurate tax collection at the federal level.

SubmissionLastly, the W-3 enables the centralized conveyance of this aggregated and verified wage and tax information to the Social Security Administration (SSA). This process streamlines administration and ensures fair, efficient, and accurate tax collection at the federal level.

IRS Form W-3 for 2023

Get FormIRS W-3 Form: Outlining the Obligated Applicants

The W-3 sample is considered obligatory by the U.S. Internal Revenue Service for any employers who have issued W-2 forms to their employees in 2022 to reconcile annual wage and tax-related information. Let's consider two examples of fictional people who need to submit the W-3 tax form for 2022 to make things clear.

Meet Daniel Simonsen, the proprietor of a thriving tech consulting firm in Silicon Valley. With many employees on his payroll, Mr. Simonsen seeks to comply with IRS rules by ensuring his company's tax data is up-to-date. Being conscious of technological advancements, Daniel finds the process more streamlined and less time-consuming when he opts to file Form W3 online, thereby maintaining an accurate record of his payroll data.

On the opposite coast, there's Martha Goodwin, an ambitious restaurateur in New York City. With her growing staff, Martha diligently keeps tabs on the IRS Form W-3 printable in 2023. This allows her to manually review and cross-check her company's year-end summary, ensuring all submitted information aligns accurately with the W-2 examples issued to her employees. Martha firmly supports the belief that complete compliance with tax laws is foundational to the integrity and reputation of her brand.

Filling Out Printable W-3 Form in 2023

Starting the new year with accurate tax records is crucial. To kickstart your tax year, obtain our W3 form for 2022 in PDF format, ensuring you have the most updated version. Remember, a W-3 form collates all the information from your W2s into one consolidated document.

- Correctly filling out this form is crucial. Start from the top by filling in your Employer Identification Number (EIN), followed by your business name and address. Carefully input all the necessary details in the template's boxes, as inaccurate or incomplete information can lead to penalties.

- Avoid errors by double-checking each entry. Ensure that data such as the total number of forms, total Medicare wages and tips, and total federal income tax withheld from wages, tips, and other compensation are accurately reflected.

- For those seeking an easier approach, consider utilizing our free fillable W3 form available online. This method cross-checks your entries against standard computations, considerably reducing the chance of mistakes.

Pay Attention

If a hard copy suits you better, you can also download the W-3 form for print from our website. With a guide at hand and meticulous attention to detail, you are less likely to encounter issues in your tax proceedings. Remember, an accurate W3 form is both a legal obligation and a valuable component for smooth financial operations.

File the W-3 Form on Time

The annual deadline for submitting your W-3 transmittal form for 2022 is January 31, 2023. This form, utilized by employers, helps establish your employees' tax conditions. It acts as a synopsis of all W-2 copies distributed by employers, outlining the total earnings, social security, or Medicare tax withheld.

Get FormTax Form W-3 & IRS Penalties

Do not underestimate the significance of providing accurate information. Filing printable IRS Form W3 late or giving false data can result in hefty penalties. Intentionally submitting falsified details may also lead to criminal charges. The IRS imposes penalties based on when you file the correct information and the size of your business. Remember, sanctions for failing the form on time start at $50 per copy. Staying vigilant during tax season can save you from unwelcome fines and stress. Ensure you file your reports accurately and promptly to avoid any potential penalties.

Federal Tax Form W-3: Questions & Answers

- What is the purpose of the W-3 tax form?This is a summary of all the W-2 copies your employer sends to the Internal Revenue Service (IRS). Apart from helping the IRS match earnings reported on individual taxpayers' returns, it confirms the total wages, social security wages, Medicare wages, and federal and state income tax withheld during the fiscal year.

- Can I obtain a 2022 W3 form printable version?Yes, our website provides a relevant printable template. This sample allows filers the flexibility to complete the report at their own convenience. However, it's essential to ensure the accuracy of information to prevent potential discrepancies or errors.

- How/Where can I get a 2022 W-3 fillable form?It can be obtained right here on our website. Our user-friendly platform makes it easy for you to fill out the sample online, review it, and make any necessary edits before submission. It's a practical, easy, and hassle-free option for those more comfortable with digital procedures.

- How long does it take to fill out the blank W3 form printable?If you have all the necessary information at hand, it might take anywhere from 15 minutes to an hour or more to complete the form. The time can vary based on the number of employees and the complexity of the data.

- Is the free printable W-3 form for 2022 available in the .doc format?IRS documents are usually provided in PDF format. However, it's possible that third-party websites or software might offer W-3 templates in .doc format for ease of editing. However, we recommend using the PDF format to avoid omissions and issues with convertion.

- Is it possible to e-file the W3 form?Yes, you can opt to file the W3 form online for efficient and fast processing. E-filing can significantly simplify the process, reduce the probability of errors, and ensure your data gets to the IRS promptly and securely.

More Form W3 Instructions for 2023

W3 Printable Form Navigating the W-3 tax form, which is an essential document for businesses, might appear intimidating when you first encounter it. But fear not, for we are here to provide you with a comprehensive guide that will not only demystify the process but also help you find it surprisingly straightforward....

W3 Printable Form Navigating the W-3 tax form, which is an essential document for businesses, might appear intimidating when you first encounter it. But fear not, for we are here to provide you with a comprehensive guide that will not only demystify the process but also help you find it surprisingly straightforward.... - 24 October, 2023

- Fillable W-3 Form The upcoming tax season makes the W-3 form a central focus. This form, also known as the Transmittal of Wage and Tax Statements, is essential if you are an employer who oversees employees subject to income tax withholdings. Here, we elucidate the specifics of the fillable W-3 form for 2022 and provi...

- 23 October, 2023

- W3 Transmittal Form Form W-3 is an essential document for business owners and employees alike. It functions as a summary report for all the W-2 forms issued by an employer within a tax year. In this article, we will provide a comprehensive overview of the IRS W-3 transmittal form, aiming to offer clear guidance and val...

- 20 October, 2023

Please Note

This website (form-w3.com) is an independent platform dedicated to providing information and resources specifically about the W3 tax form, and it is not associated with the official creators, developers, or representatives of the form or its related services.