W3 Printable Form

- 24 October 2023

Navigating the W-3 tax form, which is an essential document for businesses, might appear intimidating when you first encounter it. But fear not, for we are here to provide you with a comprehensive guide that will not only demystify the process but also help you find it surprisingly straightforward. Stay with us as we take you through a step-by-step breakdown of the free W-3 printable form, making it an accessible and user-friendly tool for your tax reporting needs.

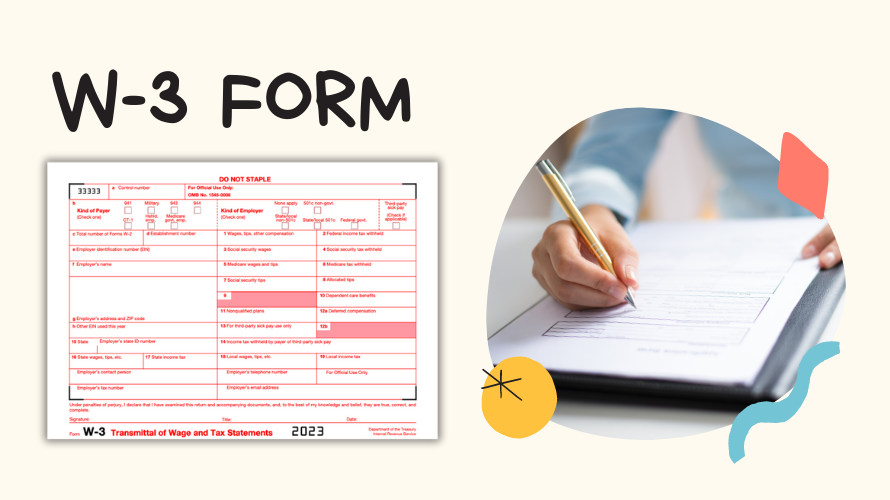

Decoding the W-3 Form Layout

Simply put, the free printable W3 for 2022 separates all the necessary information into succinct sections. The top section requests the tax year and entity's details. The form then details the employer's details and the totals for various sections of W2 forms.

Steps for Accurate W-3 Form Completion

- Verify all the business's information, including the tax year, EIN, and business name.

- Provide the summed totals from all the W-2 forms you issued throughout the year.

- Double-check all the entries to ensure their accuracy before proceeding to the next step

Submitting Your Printable W-3 Form Correctly

With the filled W3 printable form, you are one step away from successful tax form submission. Follow the instructions given in our comprehensive guide on sending the form to the correct IRS address, digitally or via mail.

- Choose the Appropriate Address

The IRS has specific addresses for different types of submissions. Ensure you have the correct address for your particular document and location. You can find the correct address on the IRS website or in the instructions for your tax form. - Select the Method

- Mail: If sending physical documents, use certified mail or a reliable courier service to ensure tracking and confirmation of delivery.

- E-File: Many tax documents can be submitted electronically through the IRS's e-file system, either directly or through an authorized e-filing service provider.

- Include a Cover Letter (If Mailing)

If mailing your documents, consider including a cover letter that explains the contents and purpose of your submission. This can help streamline processing. - Keep Copies

Always keep copies of the documents you send to the IRS for your records.

Remembering the Submission Deadlines

Timely submission of your W3 tax form for 2022 printable is crucial to avoid penalties. Generally, all W-3 forms should be sent to the IRS no later than the last day of January following the tax year. However, keep in mind that deadlines can occasionally change, so staying updated is key.

Navigating and submitting the printable W3 tax form for 2022 doesn't have to be an uphill battle. Equip yourself with the necessary knowledge, take advantage of our resources, and you will handle your tax duties effortlessly. Remember, the W-3 form is available for download on our website.