W3 Transmittal Form

- 20 October 2023

Form W-3 is an essential document for business owners and employees alike. It functions as a summary report for all the W-2 forms issued by an employer within a tax year. In this article, we will provide a comprehensive overview of the IRS W-3 transmittal form, aiming to offer clear guidance and valuable information on its application and importance in the tax preparation process.

A Brief History of the W3 Transmittal Form

The W3 transmittal form has a long-standing history with the Internal Revenue Service (IRS) and has undergone several changes to suit ever-changing economic climates. Originally introduced to consolidate individual W-2 information for employers, the form simplifies income tax reporting by summarizing year-end income and employee withholding.

Recent Changes on the IRS W3 Form

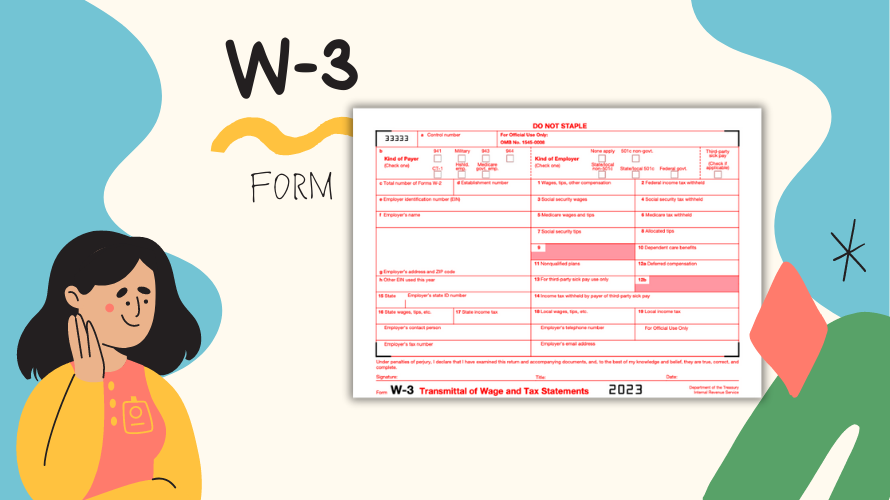

In response to the Tax Cuts and Jobs Act (TCJA), the IRS made fundamental modifications to the W3 transmittal form for 2022. These changes primarily revolve around the reporting of various taxes, including federal income tax withheld, social security wages, and Medicare wages, thus allowing a smoother taxation process.

IRS Form W-3: Eligible Taxpayers

Typically, the W3 transmittal 2022 form is exclusive to employers who are paying employee wages and have taxed their income. It's also used by employers who are issuing W-2 forms to their employees. However, it's important to note that if an employer uses the IRS's e-filing system, they will not need to fill out the W3 transmittal form. This e-filing system automates the calculation process previously done by the W-3.

Employers can optimize their tax processing by properly utilizing the W3 transmittal form. Employers should comply with the IRS's timely filing requirements to avoid penalties and ensure accurate calculations. Time and effort put into maintaining accurate payroll records throughout the year can ease the process when it comes to filling out this form.

The W-3 Tax Form Role for Employees

- An employee will not be directly involved in filling out a W3 transmittal form example, though it's beneficial to understand what the document represents.

- The W3 transmittal form is the employer’s responsibility and consolidates all W-2s issued by a company. It provides an overview of the total wages, social security, and Medicare taxes withheld from employee's paychecks.

- Accuracy on this form is crucial, as the IRS uses the data to compare records, and any discrepancies could trigger an audit.

To sum it up, the W3 transmittal form is a vital part of the U.S. tax system, assisting in the wage reporting process. Employers should exercise diligence and accuracy when completing the form to ensure a smooth tax submission process.