Fillable W-3 Form

- 23 October 2023

The upcoming tax season makes the W-3 form a central focus. This form, also known as the Transmittal of Wage and Tax Statements, is essential if you are an employer who oversees employees subject to income tax withholdings. Here, we elucidate the specifics of the fillable W-3 form for 2022 and provide you with the indispensable guidance you need to successfully file it online.

Features of the Fillable W3 Form

The key advantage of the fillable W3 form lies in its accessibility and flexibility. Unlike its standard paper counterpart, the fillable Form W-3 for 2022 can be effortlessly completed online, sans the need for printing or manual data entry. The provided fields prompt you for relevant inputs – from identification details like your Employer Identification Number (EIN) to calculated totals of remunerations and tax deductions made throughout the year. Every instruction is laid out clearly, ensuring a seamless form-completion experience.

Fillable W3 Form & Challenges of Online Filing

Engaging with fillable PDF forms, whether you're a seasoned pro or a newcomer to the realm of online filings, can indeed pose a unique set of challenges. These challenges often encompass a spectrum of issues, ranging from the occasional technical hiccups, such as data input failures, to grappling with complex tax terminology and calculations that may seem bewildering.

Furthermore, one may encounter the inconvenience of specific web browsers that do not fully support the free fillable W3 form for 2022, potentially compromising the form's display and functionality. Hence, it is of paramount importance to ensure a seamless filing experience by utilizing a browser that is well-supported, such as the likes of Google Chrome or Adobe Acrobat, which can significantly enhance your efficiency and ease when working with these forms. By opting for these browser options, you can mitigate potential obstacles and ensure a smoother journey as you navigate through the world of online tax filing and form completion.

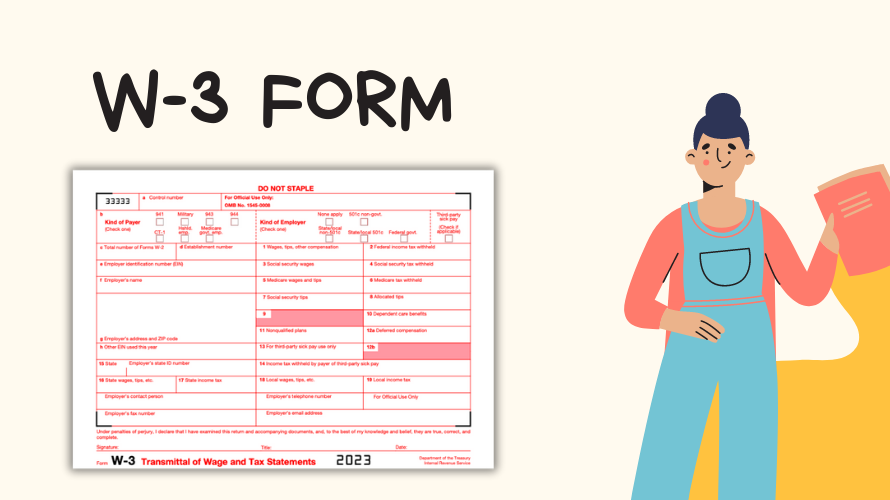

Navigating a W-3 Online Form Completion

To ensure a successful form completion, here are essential rules to follow:

- Ensure you use the correct form suited for the reporting year. For this instance, it is the 2022 form.

- Complete all the mandatory fields accurately. Double-check the inputs for computational or typographical errors.

- Use only authorized tax software or IRS-recommended print options to ensure the barcode on Form W-3 is clear and legible.

- Don't forget to sign and date the form once completed. An unsigned form can lead to unnecessary delays or rejections.

Online filing using the W3 fillable form for 2022 is designed to make your tax submission process hassle-free. Having an awareness of potential challenges and effective solutions will guarantee a smooth filing experience. Remember to follow regulated guidelines to avoid hiccups down the road because when it comes to tax filings, the devil is in the details. Equip yourself with the necessary knowledge, stay informed, and strive towards a seamless W-3 form filing for 2022.